Blogs

Orange County ADUs

Building an ADU in Orange County: What Homeowners Need to Know in 2025

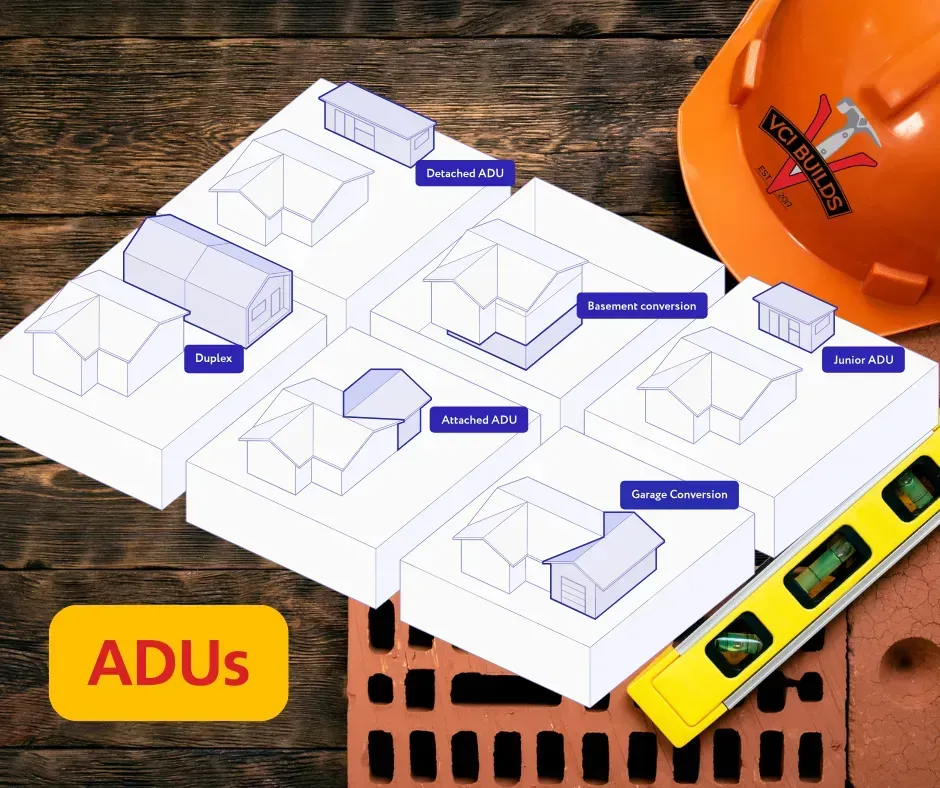

Building an Accessory Dwelling Unit (ADU) in Orange County offers homeowners an opportunity to maximize property value, add extra living space, and generate rental income. With multigenerational living on the rise and evolving local regulations and financing options, understanding the process is essential. This guide covers updated ADU regulations, cost factors, benefits, financing alternatives, design ideas for small lots, step-by-step construction procedures, and post-construction management best practices.

Transitioning from this overview, the discussion begins with the local regulations that govern ADU development.

What Are the Latest Orange County ADU Regulations in 2025?

In 2025, Orange County has revised its ADU regulations to encourage accessory dwelling unit growth while protecting neighborhood character. Homeowners must follow specific zoning laws, building codes, and permit processes designed to balance housing density with residential quality.

What Zoning Laws Affect ADU Construction in Orange County?

Local zoning laws determine the location, size, and design of an ADU. Properties must lie within residential districts that permit ADU construction. Recent amendments have expanded the building envelope and relaxed setback restrictions, allowing for creative and functional designs. Homeowners need to submit detailed site plans and compliance certificates with their permits to avoid delays.

How Do Building Codes and Permit Processes Work for ADUs?

Orange County’s building codes ensure ADUs meet high standards for safety, quality, and accessibility. The permit process requires submission of construction plans, structural designs, and environmental assessments. The local building department reviews these plans, focusing on fire safety, insulation, and plumbing and electrical systems. Inspections occur throughout construction, and permits are now typically approved within 30 to 45 days. Working with an experienced contractor familiar with local guidelines is highly recommended.

What Are the Parking and Occupancy Requirements for ADUs?

To minimize neighborhood impact, ADUs must comply with parking and occupancy rules. Non-owner-occupied ADUs generally need off-street parking, although requirements may be reduced in areas with robust public transit. Occupancy standards based on square footage, emergency egress, and maximum limits ensure safety and comfort. For instance, a 500 to 700 square foot ADU might require one parking spot and accommodate one to two occupants.

How Much Does It Cost to Build an ADU in Orange County in 2025?

ADU construction costs in Orange County vary based on size, design, and quality of finishes. In 2025, budgets typically range from $150,000 to over $400,000. Homeowners must balance upfront construction expenses with benefits such as rental income and higher property value.

What Are the Typical Construction and Material Costs?

Construction and material costs form the largest expense. Labor rates and supply chain factors drive costs, and using high-quality sustainable materials may add 10–20% to conventional prices but can yield long-term energy savings. Typical costs range from $100 to $250 per square foot, depending on the work required for foundations, framing, roofing, and finishing details.

How Much Do Permits and Design Fees Add to the Budget?

Permit fees in Orange County may range from $5,000 to $15,000, covering building and impact fees as well as inspections. Professional design services—often costing 8–15% of the project budget—can streamline the process, ensure compliance, and enhance long-term functionality and aesthetics.

What Are the Cost Differences Between ADU Types?

Costs also vary by ADU type:

Detached ADUs usually cost more but offer greater privacy and design flexibility.

What Are the Benefits of Building an ADU for Orange County Homeowners?

ADUs provide benefits beyond extra square footage. They can increase property value, generate rental income, and offer practical housing for multigenerational families—all while using available land more efficiently to alleviate housing shortages.

How Can ADUs Increase Property Value and Rental Income?

Well-designed ADUs can boost overall property value by 20–30% by attracting a broader range of tenants, from young professionals to elderly family members. Independent utilities and modern amenities increase the asset’s appeal, enhancing both immediate cash flow and long-term appraisal values.

What Lifestyle Benefits Do ADUs Offer for Multigenerational Living?

ADUs support multigenerational living by providing private spaces for aging parents, adult children, or visiting relatives. They help maintain a balance between family closeness and privacy, particularly important in high-cost areas like Orange County, where flexible, cost-effective living arrangements are in demand.

How Do ADUs Support Sustainable and Efficient Land Use?

Increasing housing density on existing lots, ADUs help reduce urban sprawl. Their designs often feature energy-efficient systems, advanced insulation, and, in some cases, renewable energy components. Such sustainable practices reduce utility costs and promote environmental conservation.

What Financing Options Are Available for ADUs in California?

Financing ADU projects involves significant upfront costs, but numerous options exist. Homeowners can explore various loan programs, grants, and special financing arrangements to make ADU construction more affordable.

Which Loans and Grants Can Help Fund ADU Construction?

Several loan options—such as construction loans, personal equity loans, and FHA-backed programs—are available. Federal, state, and local grants may also help offset permit and construction fees. Local programs often offer low-interest rates or deferred payments to encourage sustainable housing development.

How Does Home Equity Financing Work for ADUs?

Home equity financing allows homeowners to borrow against their property’s accumulated value. Options include home equity lines of credit (HELOCs) and home equity loans, both of which typically offer lower interest rates and help spread construction costs over time. Homeowners should review their credit and property appraisal details to secure favorable terms.

What Local and State Programs Support ADU Builders?

California’s local and state programs offer technical assistance, waived or reduced permit fees, and expedited reviews. In Orange County, partnerships between lending institutions and local agencies provide specialized financing that supports affordable, sustainable ADU construction.

What Are the Best ADU Design Ideas for Small Lots in Orange County?

For homeowners with small lots, smart design is key. The focus is on blending aesthetics with functionality while optimizing limited space.

How to Maximize Space With Detached and Attached ADU Designs?

Creative floor plans and multipurpose areas are essential. Detached ADUs can feature open layouts and built-in storage, while attached units like garage conversions benefit from existing structures. Design ideas such as fold-away furniture, mezzanines, and built-in cabinetry help maximize space efficiently.

What Are Popular Styles and Materials for Orange County ADUs?

Design styles range from minimalist modern to rustic coastal, ensuring ADUs complement local aesthetics. Homeowners often choose sustainable materials—engineered wood, low-VOC paints, and energy-efficient glass—to create open, light-enhancing layouts that improve both appeal and durability.

How Can Energy Efficiency and Sustainability Be Integrated Into ADU Design?

Energy efficiency is critical for reducing operating costs. Designers incorporate solar panels, high-performance insulation, and energy-efficient lighting, along with sustainable building materials and water conservation measures. Smart home systems further optimize energy use, adding long-term value and appeal to environmentally conscious tenants.

What Is the Step-by-Step Process to Build an ADU in Orange County?

A structured process ensures timely and compliant ADU construction. Homeowners work closely with architects, contractors, and local officials to follow each phase from planning to final occupancy.

How to Plan and Prepare Your Property for an ADU?

Successful projects begin with thorough planning—site evaluations, sun exposure, utility assessments, and obtaining necessary pre-approval documents, such as zoning certificates and land surveys. Landscaping may also need adjustment to integrate the ADU with the main residence. Setting a realistic budget and timeline prevents unexpected delays.

What Are the Key Stages of Construction and Project Management?

ADU construction is typically broken into several stages: design finalization, permit acquisition, foundation work, framing, installation of electrical and plumbing systems, insulation, and the final finishes. Regular inspections and effective project management—through coordination meetings and progress reports—ensure that the project remains on track.

How to Navigate Inspections and Final Approvals?

Inspections occur at critical milestones, covering foundations, electrical systems, plumbing, and final occupancy standards. Scheduling these inspections early and addressing any issues quickly is key to obtaining the final certificate of occupancy, which marks project completion.

How Should Homeowners Manage Their ADU After Construction?

Effective post-construction management is crucial for long-term ADU profitability. Homeowners must focus on tenant management, regular maintenance, and staying compliant with evolving property regulations to protect their investment.

What Are Best Practices for Tenant Screening and Property Maintenance?

Implementing a robust tenant screening process—including background checks and employment verification—is essential. Regular maintenance inspections of plumbing, electricity, and structural components help prevent costly repairs. Clear policies on rent, utilities, and emergency protocols foster reliable tenant relationships.

How Do Insurance and Property Taxes Change With an ADU?

Adding an ADU may require expanding insurance coverage and updating property tax assessments. Although taxes might increase after a reassessment, the rental income and higher property value can offset these costs. Consulting a financial advisor or real estate expert helps homeowners plan accordingly.

What Local Resources Can Support ADU Owners in Orange County?

Numerous local resources, including neighborhood associations, government housing programs, and professional property management services, assist ADU owners. Many cities offer online portals to access guidelines, schedule inspections, and receive regulatory updates. Workshops and seminars also provide valuable management insights.

Frequently Asked Questions

Q: What is an ADU and why is it popular in Orange County? A: An ADU, or Accessory Dwelling Unit, is a secondary housing unit on the same lot as a primary residence. Its popularity stems from its ability to offer extra living space, rental income, and support multigenerational living while maximizing land use.

Q: How long does the ADU permit process take in Orange County? A: The permit process typically takes 30 to 45 days, depending on project complexity and documentation completeness, with expedited options sometimes available.

Q: Can I use an existing structure to create an ADU? A: Yes, converting existing structures such as garages or basements into ADUs can reduce costs and simplify construction, if they meet current codes and zoning laws.

Q: What financing options are most common for ADU construction? A: Common financing methods include home equity financing, specialized construction loans, and state or local grant programs, which often offer lower interest rates or subsidized fees.

Q: Are there sustainable design options available for ADUs? A: Absolutely. Energy-efficient materials, solar panels, and modern insulation techniques are popular choices that reduce costs and support California’s environmental goals.

Q: How do ADUs impact property value and taxes? A: Building an ADU can raise property value by 20–30% due to added living space and rental income potential, though property taxes may increase after reassessment.

Q: Who should I consult if I’m planning an ADU project? A: Homeowners should seek advice from experienced general contractors, architects, and financial advisors. In Orange County, firms like VCI Builds offer specialized ADU construction expertise.

Final Thoughts

Building an ADU provides a valuable opportunity to enhance property value and create flexible living arrangements. From understanding updated regulations to managing construction, financing, and post-completion care, each step is crucial for long-term success. With careful planning, expert support, and smart design, an ADU can be a rewarding investment that meets both lifestyle aspirations and financial goals.

Ready to turn your property into a source of extra income or multigenerational living space? VCI Builds is Orange County’s trusted ADU expert—handling everything from design to permitting to full construction. Whether you’re just starting to explore your options or ready to break ground, our experienced team is here to make your ADU project stress-free and successful.

👉 Contact us today for a free consultation and discover what’s possible on your property.